Energy transition and security of supply

Contribution of the domestic extraction of natural resources to supply security considering Germany’s role in the international natural resource market

Latest Update: May 2025

Interesting Facts

Demand for natural resources

As an industrial and technology location, Germany is dependent on a secure supply of energy and non-energy (mineral) natural resources. Future technologies and projects such as the energy transition, electric mobility, digitalisation and decarbonisation of industry are changing the demand for certain natural resources. An increasing demand for natural resources such as lithium, rare earths, cobalt, nickel and copper is confirmed by regularly updated studies:

- International Energy Agency (IEA) – Global Critical Minerals Outlook 2024

- EU Commission – Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study (2023)

- Federal Institute for Geosciences and Natural Resources (BGR) / DERA (German Raw Materials Agency) – Raw materials for future technologies (2021)

Basic pillars of the German supply of natural resources are domestic primary raw material extraction, the availability of secondary raw materials and raw material imports.1

Domestic primary raw materials

The demand for quarried natural resources (mainly for the building materials, glass and ceramics industries), potash products (for agriculture), rock salt (especially for the chemical and pharmaceutical industries as well as as as de-icing salt) and some industrial minerals can be met entirely from domestic natural resource sources. Individual energy resources such as lignite and natural gas as well as petroleum are also extracted close to consumption in Germany and contribute to the security of supply with natural resources (see also Which raw materials are extracted in Germany).2

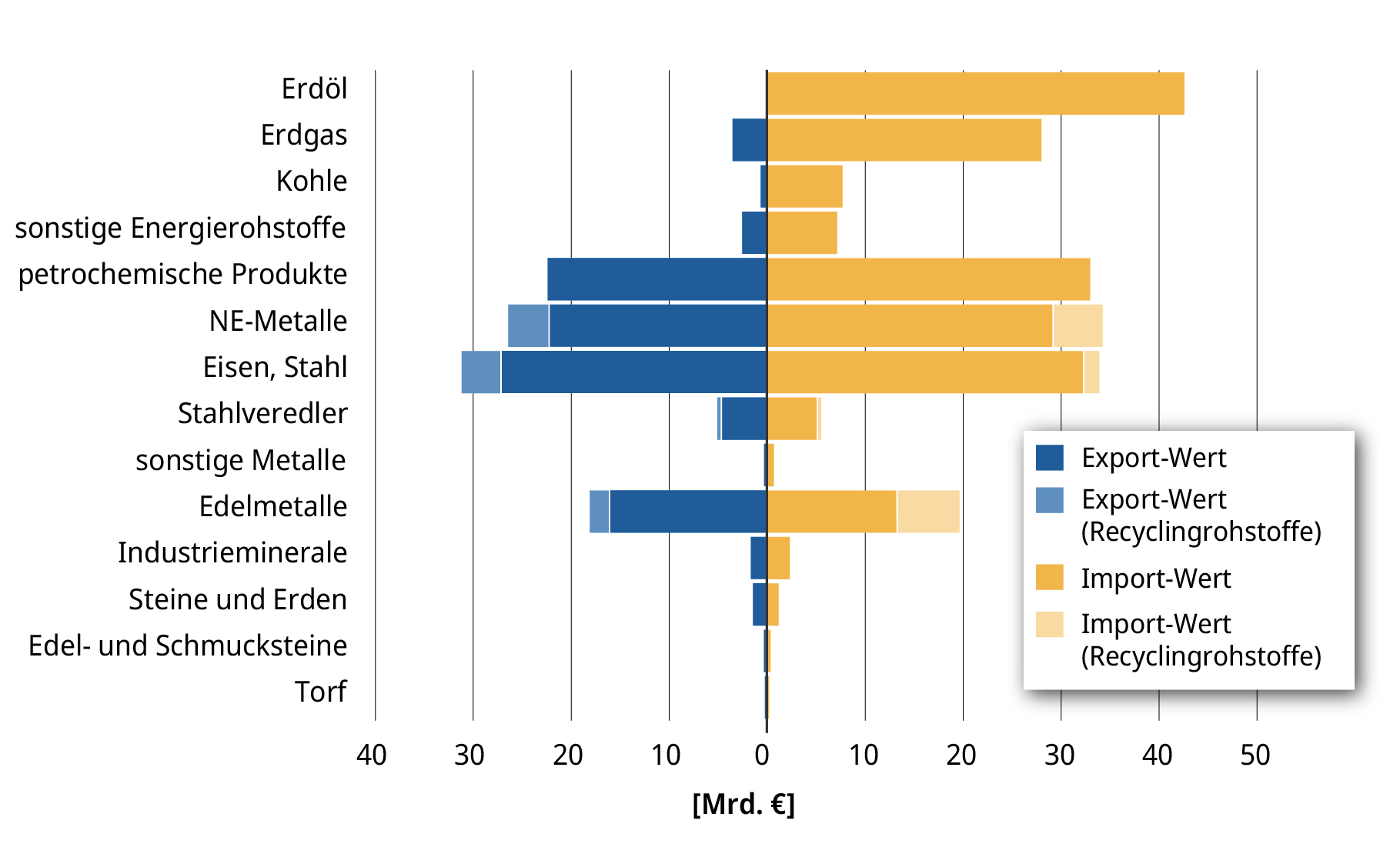

Mineral raw materials for future technologies are currently only produced in small quantities from mining in Germany. These include industrial minerals such as fluorite and barite, graphite, feldspar and coarse-grained quartz or quartz gravel for the production of silicon, but also lithium.3,4 Compared to other countries, high environmental and social standards apply to extraction. However, production is not sufficient to meet the demand for natural resources and other metals such as cobalt, nickel or rare earths are not extracted in Germany. This is also evident from the following graph on the foreign trade balance.

Figure 8: Foreign trade balance by value in 2023

Source: BGR – Bundesanstalt für Geowissenschaften und Rohstoffe [Federal Institute for Geosciences and Natural Resources] (2024) (see footnote 5)

Secondary raw materials from recycling

Some metallic natural resources, such as iron/steel, lead and aluminium, are often not consumed but used due to their good recyclability. They can be returned to a product cycle after processing, although this recycling process does not function endlessly and is energy-intensive due to the loss of material. Many products made from non-metallic raw materials, on the other hand, are often chemically modified (e.g. cement, concrete) and therefore cannot be returned directly to the product cycle. However, some can be recycled as substitutes (e.g. building materials) for primary raw materials (recycled or secondary raw materials).

Secondary raw materials contribute to the domestic supply of raw materials and reduce import dependency. For example, aluminium is on the list of strategic raw materials of the Critical Raw Materials Act (CRMA), a European regulation on critical and strategic raw materials that requires, among other things, an increase in processing and recycling capacities in the EU. In 2023, around 2,976,000 tonnes of aluminium were produced in Germany, for which 2,786,000 tonnes of aluminium were recycled.6 The share of secondary raw materials (steel and iron scrap) in steel production was around 42% in 2023.7

This is not the case, for example, with lithium, which is also one of the strategic raw materials on the CRMA list and is mainly contained in batteries. Recycling processes for lithium are technically complex processes8 and lithium recycling of batteries currently takes place only to a small extent. It is expected that lithium demand will rise sharply in the coming years, and in addition to the primary supply, the secondary sector will play an increasingly important role in the future for the overall supply. Many batteries from electric vehicles are estimated to reach the end of their life9 in 8-10 years and are only then available for recycling.10 To strengthen the circular economy, the Federal Government has adopted the National Circular Economy Strategy (NKWS) 2024 (see Circular economy, in particular recycling).

The goal specified therein is to reduce the critical import dependencies on raw materials, strengthen the circular economy and reduce the overall consumption of raw materials in order to achieve a resilient, sustainable supply of raw materials. Successful implementation requires a rethink of industrial and innovation policy at the various international levels, as well as in Germany. This includes the targeted promotion of material-efficient approaches to the absolute reduction of the use of raw materials in industrial production (e.g. lightweight construction taking into account recyclability), of ecodesign approaches (e.g. improving the durability, reusability and repairability of products) and of approaches to the substitution of non-renewable, scarce or critical raw materials (see also Circular economy, in particular recycling). Securing high-quality secondary raw materials from the recycling processes for the economic cycle is a factor for increased use. The right economic and environmental incentives must be put in place to ensure that our raw material supply is responsible and secure in the future.

However, the supply of recycled materials is not sufficient to fully compensate for the rising demand for raw materials for the transformation of energy supply and for other future technologies. In view of the geopolitical developments and the challenges mentioned in relation to the import of raw materials, the Federal Government sees the need to strengthen diversification in the supply chains of critical and strategic raw materials as well as domestic raw material extraction in cooperation with companies in the medium and long term.

Natural resource impports

In the case of metals, individual industrial minerals and energy raw materials (with the exception of lignite), the industry is heavily dependent on imports from outside Europe and thus on the availability on the international raw material markets. At 298.4 million tonnes, Germany imported almost 13% less raw materials in 2023 than in the previous year. Imports of energy raw materials (-15.1%), non-metals (-8.9%) and metals (-6.9%) declined significantly. In 2023, energy raw materials, metals and non-metals (of which about 57% are industrial minerals) worth €216.2 billion were imported into Germany.11 Further information on import volumes in the D-EITI sectors of German raw material extraction (petroleum and gas, lignite and hard coal, salts, stones/earths, industrial minerals, iron ore) can be found under the topic The extractive industry in Germany.

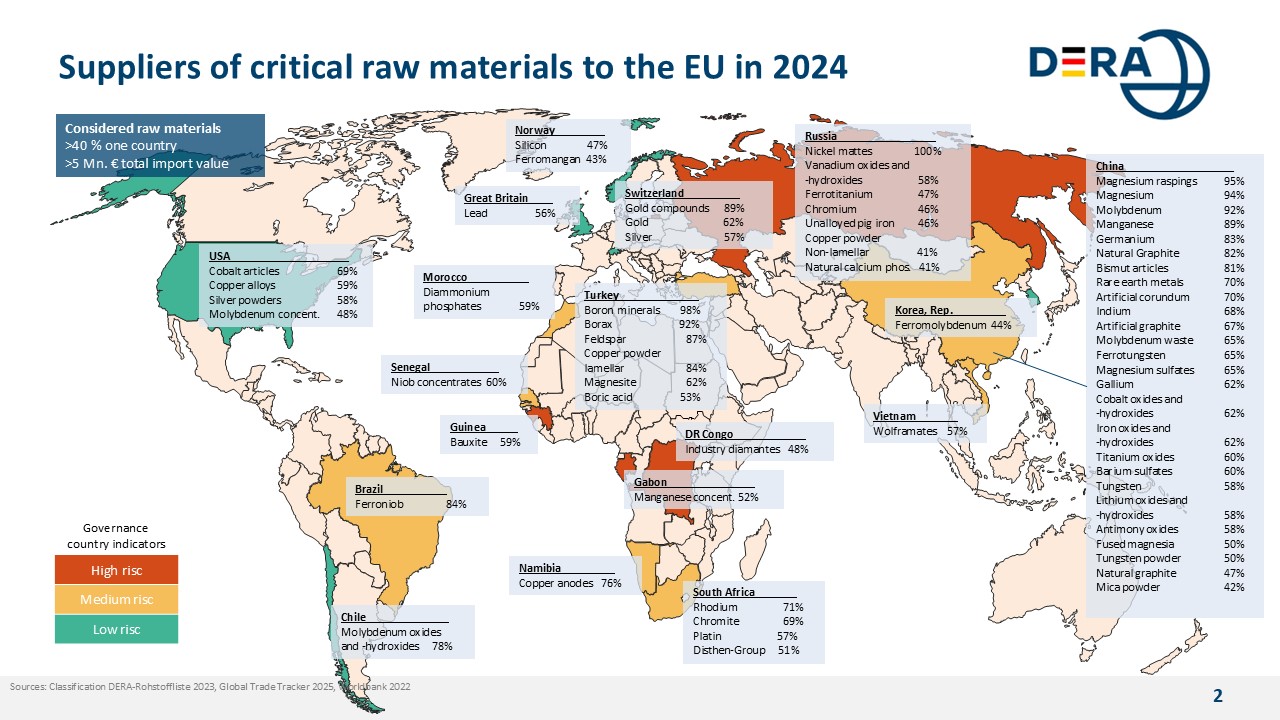

The world map (Figure 10) shows the most important supplier countries of the EU in 2023 of 60 potentially critically categorised mining, refining and commercial products (see DERA list of raw materials 202312), of which more than 40% come from one country and had a total trade value of more than 5 million euros in 2023.13 The BGR report “Germany – Raw Materials Situation”14 publishes annual data on German imports of the most important critical and strategic raw materials. A complete list of these imports can be found at Destatis.15 It should be noted that a significant proportion of raw materials is imported via EU countries, but these are only intermediate stations in the raw materials trade.

Figure 9: EU import dependency on critical raw materials in 202316

Source: DERA – from Chart of the Month, August 2023 (updated for the year 2023)

Therefore, an examination of Germany’s import dependency from the perspective of the German import figures is only partially meaningful. The degree of diversification of raw material imports on the EU internal market in Graph 9 also illustrates Germany’s dependence on imports.

Critical aspects of Germany’s raw material supply

Access to resources and the development of diversified value chains are of strategic importance for Europe’s goal of implementing the Green Deal17 and ensuring security of supply, which is also necessary for digitalisation, aerospace and defence. International competition for raw materials, especially for critical and strategic raw materials, is subject to increasing market restrictions. The restrictions result from government control measures in the commodity-producing countries and the sometimes high concentration of companies on the supply side, both in mining and in the processing of raw materials.

23 of the 61 (38%) raw materials shown in the figure (see Graph 9) are delivered to the EU from China. Thus, China dominates the international market for a variety of raw materials. China is currently the most important country for the extraction and, above all, for the first stage of processing of potentially “critical raw materials”. Among them is a large number of special metals such as magnesium, manganese, bismuth, germanium, gallium, cobalt or rare earth metals. For example, the export controls imposed by China in 2023 on the critical raw materials gallium, germanium and their compounds are a risk factor for a free commodity market, as the country has a production share of primary gallium and germanium of 90% and 80% respectively.18 In addition to antimony, China expanded the list of raw materials whose export is subject to authorisation in February 2025 (indium, molybdenum, bismuth, tungsten and tellurium).19 Against the backdrop of the trade conflict with the USA, China is increasingly using export controls on raw materials as an instrument, thus exacerbating the escalating spiral of mutual sanctions.

The Russian war of aggression against Ukraine in early 2022 and the associated restrictions have increased the risks for raw material procurement due to shortages, price increases and disruptions in the supply chain. In addition to natural gas, petroleum and hard coal, imports of a number of metals such as nickel, titanium, palladium and copper from Russia and copper, iron and ferroalloys from Ukraine fell sharply.

Figure 10: Map of projects for the promotion of critical raw materials in Germany

A selection of domestic extraction sites, exploration projects and licensed mining sites for critical raw materials is shown in Figure 10 (as of May 2024). Projects identified as significant are already at an advanced stage of exploration (e.g. granted licenses or existing feasibility studies) or already contribute to the supply of the domestic industry with critical natural resources.

The private sector deplores the complexity and the high time requirement of approval procedures in the German extractive sector. In addition, the lack of public acceptance that is often at hand makes it difficult to explore and extract natural resources in Germany.20 In order to illustrate the ambivalent nature of the natural resource production21, it is crucial from the point of view of civil society to show not only the economic gains but also the social and environmental impacts of primary natural resources extraction at home and abroad.

The status of domestic mining projects for the extraction of critical and strategic raw materials is presented in the BGR Short Study (2024) and in the BGR Raw Materials Study (2023). With regard to critical raw materials in addition to other deposits, the domestic lithium deposits and projects are relevant for future lithium availability in order to support the transformation towards a more sustainable energy economy (see “Summary from BGR study”).

The national lithium extraction projects are summarised here according to the BGR study and further information is provided.

Summary from BGR study: Lithium extraction projects in Germany

The transboundary solid rock deposit in Zinnwald (Ore Mountains, Saxony/Cínovec, Czech Republic) is considered one of the largest lithium deposits in Europe. Tin and tungsten were mined at the same site until the 20th century. Zinnwald Lithium GmbH (Zinnwald Lithium Plc) is currently exploring the site at an advanced stage. Furthermore, the company also holds exploration licences for lithium for the nearby licensed mining sites of Falkenhain, Sadisdorf-DL, Altenberg-DL and Bärenstein.

Part of the domestic lithium demand could in future also be produced as a by-product from geothermal power plants. Locations in Germany where lithium is explored from geothermal sources are mainly in the Upper Rhine Graben as well as in Saxony-Anhalt, Lower Saxony and Mecklenburg-Western Pomerania. In total, there are currently around 50 prospecting licenses for lithium as a by-product of geothermal energy production in Germany. Between 2 and 12% of the annual lithium demand in Germany could theoretically be met by existing geothermal power plants in the Upper Rhine Graben and the North German Basin.22

Using lithium extraction downstream of geothermal energy production, the company Vulcan Energie Ressourcen GmbH (Vulcan Energy Resources Ltd.), plans to extract lithium from thermal waters of the Upper Rhine Graben. Vulcan holds a total of 16 prospecting licences for lithium from geothermal sources in the Upper Rhine Graben (Rhineland-Palatinate, Baden-Württemberg and Hesse) with a total area of 1,771 km² in Germany.

The company Neptune Energy Deutschland GmbH is planning to extract lithium in Altmark, Saxony-Anhalt. This involves the extraction of lithium from the reservoir waters of the former natural gas field of Altmark. In April 2024, the company received mining authorisation for the extraction of lithium from the competent state office for geology and mining in Saxony-Anhalt.

[Addendum 2025]: In January 2025, Esso Deutschland GmbH received mining-law permission from the responsible State Office for Mining, Energy and Geology (LBEG) in Lower Saxony for a total of four licensed mining sites. Esso Deutschland GmbH strives to extract lithium from deep formation water for commercial use. The permits issued are valid for the “Greetsiel IV” licensed mining site in Emden and in the Aurich district, the “Hengstlage” licensed mining site in the Cloppenburg and Oldenburg districts and for the “Hemslingen” and “Wolterdingen” licensed mining sites in the Rotenburg (Wümme) and Heidekreis districts.

Local energy suppliers are also working on the commercial exploration and extraction of lithium from geothermal plants. The Bruchsal pilot plant, which is managed by EnBW Energie Baden-Württemberg AG is operated jointly with Stadtwerke Bruchsal GmbH, which tests lithium extraction from saline thermal waters under real thermodynamic conditions (BMWK project “UnLimited”).

In September 2024, AMG Lithium GmbH opened the first module of its lithium hydroxide refinery (Bitterfeld/Wolfen, Saxony-Anhalt) with an annual capacity of 20,000 tons per year, sufficient for the batteries of about 500,000 electric vehicles. In the future, up to five modules are to be added, depending on the market environment (AMG 2024).

Each year, Nickelhütte Aue GmbH recycles 4,000 tons of lithium-ion batteries, according to its own data, it has capacities for 10,000 tons annually. The Duesenfeld GmbH from Wendeburg recycles lithium-ion batteries and recovers lithium. ACCUREC Recycling GmbH commissioned a lithium recovery plant in 2023 and recycled 3.8 million kg of Li batteries in 2023. The company Ecobat Group operates a lithium recycling plant in Hettstedt.

Measures to ensure and increase resilience23

Securing the supply of raw materials in Germany is primarily the responsibility of the companies. It is the task of the raw materials policy to provide companies with suitable and reliable framework conditions to support them in putting their raw materials supply on a secure, social, economic and ecological basis. The gaps in the EU’s capacity for extraction, refining, processing, recycling (e.g. for lithium or rare earths) and in the circular economy lead to high and sometimes critical dependencies in the supply of natural resources.

The EU Regulation on Critical Raw Materials (CRMA) adopted new framework conditions for the extractive sector in May 2024. As a member of the European Union, Germany is obliged to implement the requirements of the CRMA in accordance with the deadlines. Deadlines for national implementation are, for example, the establishment of single points of contact in the federal states for coordinating and facilitating approval procedures for projects in the area of critical raw materials by February 2025 (Art. 9) or the establishment of an exploration programme with measures to improve information on critical raw material deposits by May 2025 (Art. 19).24

The aim of this law is to reduce the EU’s dependence on imported raw materials and to minimise the associated risks. The CRMA identifies 34 critical and 17 strategic raw materials that are essential for key industries such as renewable energy, digitalisation, defence and space. By 2030, all stages of Europe’s critical raw material value chains should be strengthened, so that 10% of Europe’s annual demand for strategic raw materials can be met by extraction within the EU, 40% by processed raw material products from the EU and 25% by recycling within the EU. The aim is also to diversify sources of supply for strategic raw materials and to import a maximum of 65% of a strategic raw material from a single third country.

Extraction, processing, recycling and substitution projects can be submitted to the EU Commission in order to obtain recognition from the EU Commission as a strategic project. By August 2024, 170 applications for recognition as a strategic natural resource project had been submitted to the EU Commission during the first phase of implementation. Of these, most were from the EU (124) and some from non-EU countries (46). The applications cover a wide range of critical and strategic raw materials, including lithium, nickel, cobalt and graphite, and cover all value-added stages of the raw material supply: 77 extraction projects, 58 processing projects, 30 recycling projects and 5 substitution projects (for more information see EU Commission). 12 applications for strategic projects were submitted from Germany: 5 extraction, 3 processing, 2 recycling and 2 substitution projects. Strategic projects benefit from accelerated approval procedures: maximum 27 months for mining projects, 15 months for processing and recycling projects. In March 2025, the EU Commission published the list of strategic projects. Out of 47 selected projects, 3 German projects received strategic project status.

The implementation of strategic raw material projects requires high investments. Against this background, the Federal Government commissioned KfW in 2024 to set up a “Raw Materials Fund” to reduce dependencies for critical raw materials. The resources of the Raw Materials Fund are intended to support projects at home and abroad that contribute to the security of raw materials supply and serve the extraction, processing and recycling of critical or strategic raw materials in the sense of the CRMA. The financing budget will generally be between € 50 million and €150 million per project, with a total investment of approximately € 1 billion. Investments in projects for the extraction, processing and recycling of critical raw materials are intended to ensure long-term security of supply for German and European companies. Further information on the criteria for possible participation as well as contact persons of KfW can be found on the KfW website at: Raw materials fund | KfW

Established cooperation structures exist for the domestic extraction of raw materials and the safeguarding of raw material geological data in Germany. The State Geological Services (SGD) of the federal states collect the necessary raw material geological and raw material economic data for the securing of raw materials, publish raw material geological maps and specialist planning maps and prepare or participate in raw material and monitoring reports, raw material strategies or raw material security concepts.25 SGD and the Federal Institute for Geosciences and Natural Resources (BGR) are in close contact. In addition, BGR participates in various European projects and bodies (e.g. GSEU26) and cooperates with geological services at European level.

BGR reports annually on the raw material situation in Germany. Data on domestic raw material production, German foreign trade, the use of secondary raw materials from recycling, the development of raw material prices and raw material consumption are presented in the context of Germany’s supply situation with mineral and energy raw materials.27

Developments on the international raw materials markets for mineral raw materials, fossil energy raw materials and recycled raw materials are continuously analysed and evaluated by the BGR and the German Raw Materials Agency (DERA) located there. The DERA price monitor informs the public about current price developments28 on a monthly basis. The DERA Natural Resources List 2023 is a study of developments on international natural resource markets, investigating the concentration of supply as well as the country risk of the production of numerous mineral raw materials and their intermediates. It is updated every two years. In this way, the authorities are making an important overall contribution to securing the supply of natural resources in Germany.

Another important factor for a resilient extractive industry is its acceptance by the population. Compliance with the highest environmental and social standards can contribute to acceptance of raw material extraction (cf. Sustainability in the raw material extraction). Proper and constructive stakeholder involvement29 is particularly important in the extractive sector, which has a significant impact on society, the economy and the environment. In the opinion of the Federal Government, continuous, constructive dialogue with the population is therefore essential. As part of its raw materials strategy, the Federal Government is committed to increasing awareness and social understanding of the importance of domestic raw material production. This is also the aim of the EITI implementation in Germany.

The domestic extractive industry is already implementing numerous measures to promote enlightened, critical discussion, including the provision of information material that can also be used in schools and universities30, active, early communication and public participation in new projects, and voluntary self-commitments to transparent disclosure of data along the entire value chain.31 The provision of extracurricular places of learning for environmental education, e.g. in certified geoparks and geotopes32, or the United Nations education campaign “Education for Sustainable Development (BNE)” can also contribute to an understanding of domestic extraction of natural resources.

Germany’s role in the international natural resource market

The Federal Ministry for Economic Affairs and Climate Action (BMWK) is working to expand cooperation with international partners in the extractive sector. The aim is to promote the diversification of international sources of raw materials and to expand cooperation with countries and regions rich in raw materials.33 Bilateral natural source cooperation (e.g. with Chile, Australia and Canada) as well as multilateral formats such as the Minerals Security Partnership (with the participation of the USA, Japan, Canada, Australia, Korea, France, Norway, Finland, Sweden and the EU-COM) come into play.

In a total of eight countries or regions (Australia, Brazil, Chile, China, Western Africa, Canada, Peru, Southern Africa), centres of excellence for mining and raw materials have also been established at the respective chambers of commerce abroad. They offer advisory services for locally based or German companies and hold local dialogues with government agencies and multipliers from the respective mining and extractive sectors, also to raise awareness of the requirements for sustainability standards along the entire supply chain and to prepare cooperation offers for bilateral cooperation.

The diversification of raw material supply, which contributes to achieving the goals of the 2030 Agenda for Sustainable Development, should be implemented in compliance with high sustainability standards. The Federal Government expects all German companies operating internationally, regardless of their size, to fulfil their responsibility to respect human rights along raw material value chains.34 The UN Guiding Principles on Business and Human Rights35, the OECD Guidelines for Multinational Enterprises on Responsible Business Management36 and the ILO Tripartite Declaration of Principles on Multinational Enterprises37 are the benchmarks for corporate due diligence. Specifically for minerals from conflict-affected and high-risk areas and for stakeholder participation, there are also OECD38 guidelines with specific recommendations in the area of human rights due diligence (see also Employment and Social Affairs).

The obligations under the Act on Corporate Due Diligence in Supply Chains (LkSG), which have been in force since 1 January 2023, are in principle also applicable to the import of natural resources. This is the case for companies with a registered office or branch in the country (see also Employment and Social Affairs). The Federal Office for Economic Affairs and Export Control (BAFA) monitors39 the implementation of the law.

Initiatives such as the European Battery Alliance have already triggered significant public and private investment that strengthens technologies, skills and competences in refining and metallurgy as a critical part of the value chain. The Federal Government has been actively and constructively involved in the drafting of the EU Regulation (2017/821) on so-called conflict minerals and has thus laid down rules for corporate responsibility (see also Employment and Social Affairs “Corporate Responsibility”). The European Raw Materials Alliance (ERMA)40 supports projects that serve the European supply of critical and strategic raw materials.

The multilateral initiative Mineral Security Partnership (MSP)41, which is also supported by the Federal Government, aims to strengthen critical raw materials supply chains. The CRMA and MSP Initiative also aim to ensure that critical minerals (natural resources) are produced, processed and recycled in a way that helps countries to realise the full economic development potential of their mineral resources.

The Federal Government supports the Extractive Industries Transparency Initiative (EITI), which aims to increase transparency in the extractive sector so that revenues in the extractive sector flow into the state budget of the respective countries.42 Although China and other non-EITI implementing countries produce most of the critical raw materials, the EITI publication “Mission critical”43 from 2022 documents the raw materials policy of worldwide producing countries and potential producing countries of “critical raw materials” that are already implementing the EITI standard. An overview of the production of key natural resources (lithium, cobalt, nickel, copper and rare earths) for the implementation of greenhouse gas neutral technologies in countries implementing EITI, is provided by the EITI report Strengthening governance of critical minerals44 from 2022.

Sources

1 See Natural Resources Strategy of the German government: Sicherung einer nachhaltigen Rohstoffversorgung Deutschlands mit nichtenergetischen mineralischen Rohstoffen (2020) (Securing a sustainable supply of non-energy mineral resources for Germany (2020))

2 Federal Institute for Geosciences and Natural Resources (BGR) (2017): Domestic mineral raw materials – indispensable for Germany

3 BGR (2024): Study: Critical mineral resources in Germany

4 BGR (2024) Report on the natural resources situation in Germany 2023

5 BGR – Bundesanstalt für Geowissenschaften und Rohstoffe [Federal Institute for Geosciences and Natural Resources] (2024): Germany – Natural resources situation 2023

6 Aluminium Germany (2025): Production of raw aluminium

7 Wirtschaftsvereinigung Stahl (Business Association Steel) (2023): Steel scrap – 2023 statistical report

8 Fraunhofer ISI: Recycling capacities of lithium-ion batteries in Europe – Developments 2024

10 DERA – German Raw Materials Agency at the Federal Institute for Geosciences and Natural Resources (2023): DERA raw material information: Raw materials risk assessment – lithium

11 BGR (2024) Report on the raw materials situation in Germany 2023; p.22

12 DERA – German Raw Materials Agency at the Federal Institute for Geosciences and Natural Resources (2023): DERA list of raw materials 2023

13 DERA – German Raw Materials Agency at the Federal Institute for Geosciences and Natural Resources (2023): China, Russia and the USA are the most important suppliers of many raw materials

14 BGR (2024) Report on the natural resources situation in Germany 2023

15 Destatis (2025) Statistics “External trade”, table code 51000-005 “Export and import (external trade): Germany, years, commodity classification”

16 European Commission (2023): Establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020

17 The Green Deal is a key strategy of the European Union aimed at reducing the consumption of raw materials, promoting the circular economy and higher recycling rates, and reducing Europe’s import dependencies. At the same time, a sustainable and secure supply of raw materials for future technologies is to be ensured. As a member state of the EU, Germany is bound by the relevant EU directives and regulations.

18 DERA – German Mineral Resources Agency (2023): DERA Resources List 2023. – DERA Information on Natural Resources

19 GTAI Germany Trade & Invest (2025): China introduces export requirements for critical metals

20 Bundesanstalt für Geowissenschaften und Rohstoffe [Federal Institute for Geosciences and Natural Resources] (2024): Germany – Natural resource situation 2023

21 Mancini L., Vidal Legaz B., Vizzarri M., Wittmer D., Grassi G., Pennington D. Mapping the Role of Raw Materials in Sustainable Development Goals. A preliminary analysis of links, monitoring indicators, and related policy initiatives. EUR 29595 EN, Publications Office of the European Union, Luxembourg, 2019. ISBN 978-92-76-08385-6, doi:10.2760/026725, JRC112892 (p. 60).

22 Karlsruhe Institute of Technology (KIT) (2023): Sustainable lithium for many decades

23 Resilience is the ability to maintain the functioning of a system (in this case the raw material processing industry) in the event of disruptions (e.g. in the supply chains).

24 An exploration programme for critical natural resources is not yet available at the time of preparation of the 7th D-EITI report.

25 Published on the website of the Saxon State Ministry for Economic Affairs, Labour and Transport, the Hessian State Office for Nature Conservation, the Environment and Geology and the State Office for Geology and Mining of Saxony-Anhalt

26 GSEU – Geological Service for Europe

27 BGR – Bundesanstalt für Geowissenschaften und Rohstoffe [Federal Institute for Geosciences and Natural Resources] (2024): Germany – Raw materials situation 2023

28 DERA – German Raw Materials Agency at the Federal Institute for Geosciences and Natural Resources

29 OECD (2017): OECD Due Diligence Guidance on constructive stakeholder participation in the extractive sector

30 Teaching materials such as GeoKoffer, natural stone and sand/gravel brooch, lime museum – fascinating lime and raw material extraction & biodiversity.

31 See also Bundesverband Erdgas, Erdöl und Geoenergie e.V. (BVEG) (GERMAN ASSOCIATION FOR NATURAL GAS, PETROLEUM AND GEOTHERMAL ENERGY) (2021). URL: https://www.bveg.de/umwelt-sicherheit/gutes-foerdern/transparenz- foerdern/ and/or https://www.bveg.de/der-verband/organisation/selbstverpflichtung/

32 Working Group of German Geoparks (AdG) (2024): Geoparks in Germany

34 See other specifications: Employment and Social Affairs “Corporate responsibility”.

35 UN (United Nations) (2020). URL: https://www.globalcompact.de/migrated_files/wAssets/docs/Menschenrechte/Publikationen/leitprinzipien_fuer_wirt- schaft_und_menschenrechte.pdf

36 OECD (Organisation for economic cooperation and development; 2011). URL: http://mneguidelines.oecd.org/48808708.pdf

37 ILO – International Labour Organization (2022): Tripartite Declaration of Principles on Multinational Enterprises and Social Policy

38 OECD Guideline for Due Diligence Guidance on Responsible Supply Chains for Conflict-Affected and High-Risk Minerals (2019) and OECD Due Diligence Guidance on constructive stakeholder participation in the extractive sector (2017)

39 German Agency for Economic Affairs and Export Control (2024)

40 European Raw Materials Alliance (ERMA)

41 Minerals Security Partnership (MSP)

42 Natural Resources Strategy of the German government: Sicherung einer nachhaltigen Rohstoffversorgung Deutschlands mit nichtenergetischen mineralischen Rohstoffen (2020) (Securing a sustainable supply of non-energy mineral resources for Germany (2020))

43 Kathryn Sturman, Julia Loginova, Sandy Worden, Joshua Matanzima and Andrea Arratia-Solar (2022): Mission critical Strengthening governance of mineral value chains for the energy transition

44 EITI (2022): Making the grade: Strengthening the governance of critical minerals